This post is based on the 10 Years of CFI: Skills in Demand webinar.

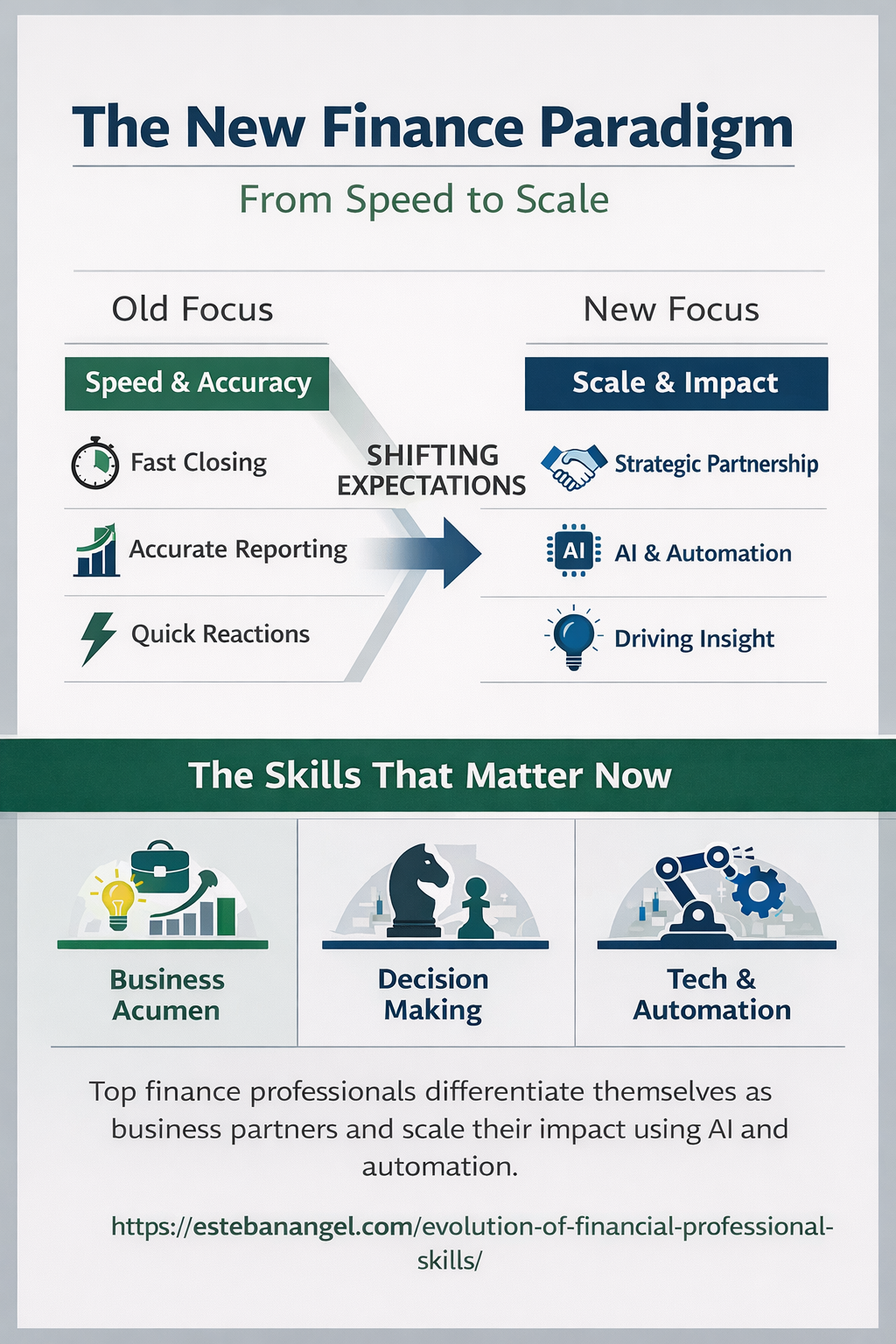

Over the last decade, the skill set expected from financial professionals has shifted significantly. This shift has been driven largely by advances in technology, automation, and AI. While the fundamentals of finance remain intact, the way value is created inside organizations has evolved.

If you are a finance professional who is planning to enter the field or advance your career, this post is for you.

Speed Is Still Required, but It’s No Longer Enough

Historically, finance professionals were primarily valued for two things: speed and precision. Being able to react quickly, close reports on time, and maintain strong attention to detail were core differentiators. Mastery of spreadsheets, hotkeys, and financial models defined competence.

Those skills still matter. Speed and reliability remain relevant skills. However, they are no longer what differentiate top performers.

The Rise of Scale as a Core Expectation

Today, scale is as important as speed.

Organizations no longer expect finance teams to simply report results or produce analyses in isolation. Instead, finance professionals are expected to extend their impact across the business. This means working closely with commercial, operational, and leadership teams.

By partnering with decision makers, financial professionals expand their reach and increase their influence across the organization. This often results in higher visibility, stronger credibility, and better career opportunities.

In practice, this shifts the role from transactional reporting to active business partnering.

An Expanded Scope of Work

Technology has fundamentally changed how finance work is distributed. Automation and AI-enabled agents allow professionals to handle a broader range of responsibilities without a proportional increase in effort.

As a result:

- Less time is spent manually producing numbers.

- More time is spent interpreting results and explaining implications.

- Finance professionals increasingly “wear multiple hats,” combining analytical, strategic, and communication skills.

The job is no longer confined to the finance function; it extends into the business itself.

The Most In-Demand Skills Today

As expectations have shifted, so have the most sought-after skills. Two stand out clearly.

1. Business partnering

The ability to communicate insights, explain trade-offs, and frame decisions in business terms has become critical.

2. AI and automation literacy

Professionals who can design, maintain, or leverage automated workflows can scale their output and focus on higher-value work.

Manual data crunching has not disappeared, but it has become far less valuable as a differentiating skill. Technology increasingly handles repetitive processing. What remains scarce is sound judgment and business acumen.

New Team Dynamics in Finance

Finance professionals are now more embedded within teams than ever before. Rather than operating as a downstream reporting function, finance is increasingly present throughout the decision-making cycle.

This shift has reinforced the importance of:

- Human judgment

- Business intuition

- Contextual understanding of trade-offs and opportunity costs

Business partners are less interested in raw numbers and more interested in what those numbers mean—what risks they imply, what opportunities they unlock, and what decisions they support.

A Real-World Observation

This evolution is visible in my own work.

Earlier in my role, most of my effort went into building and maintaining reporting infrastructure. Once that infrastructure was in place, the nature of conversations changed. Stakeholders were no longer focused on the mechanics of the numbers. They wanted to understand variances, implications, and potential actions.

The value was no longer in producing reports; it was in interpreting them. Once I understood the new rules of work, I focused my energy on interpreting results and communicating them clearly to stakeholders.

What This Means for Future Finance Professionals

For professionals entering or advancing in finance, the implications are clear:

- Commit to continuous learning.

- Stay current with automation and AI tools.

- Go beyond reporting—connect variances to business drivers.

- Be able to explain trade-offs, risks, returns, and downstream effects.

- Maintain speed and reliability, but use them to scale insight rather than output.

The finance professional of the future is not defined by how fast they close a report, but by how effectively they help the business make better decisions.